Which DeFi Tokens Are Surging and Why?

Investigating on-chain and off-chain activity of REN, LEND, and KNC

Dear Crypto Asset Investors,

While Bitcoin and Ethereum continue to tread water, a growing number of DeFi-related assets have managed to decouple from BTC’s massive gravitational pull and chart their own path upward.

We have been keeping a close eye on three DeFi tokens including REN, LEND, and KNC over the past few months. After making an account on the crypto-data provider Santiment’s website, we were happy to see that they provide metrics for a full range of coins including the three we are investigating at the moment. We found that all three coins have increasing transaction counts on-chain, lower available supply on exchanges, and holders are accumulating.

1.) Strong Uptrend in On-chain Activity

Outside of their price action, REN, LEND and KNC all share a similarly consistent growth in their network activity over the past several months. The average amount of daily addresses interacting with REN in July so far has been 588, up +36% from June, +181% from May and +332% from April. Here’s the average amount of daily active addresses from January until now for the coins in question:

Source: Santiment

We’ve also seen similar trends in REN, LEND and KNC’s network growth, or the amount of new addresses created on their networks over time. Here’s the average amount of new addresses created daily on these three networks from January until now:

Source: Santiment

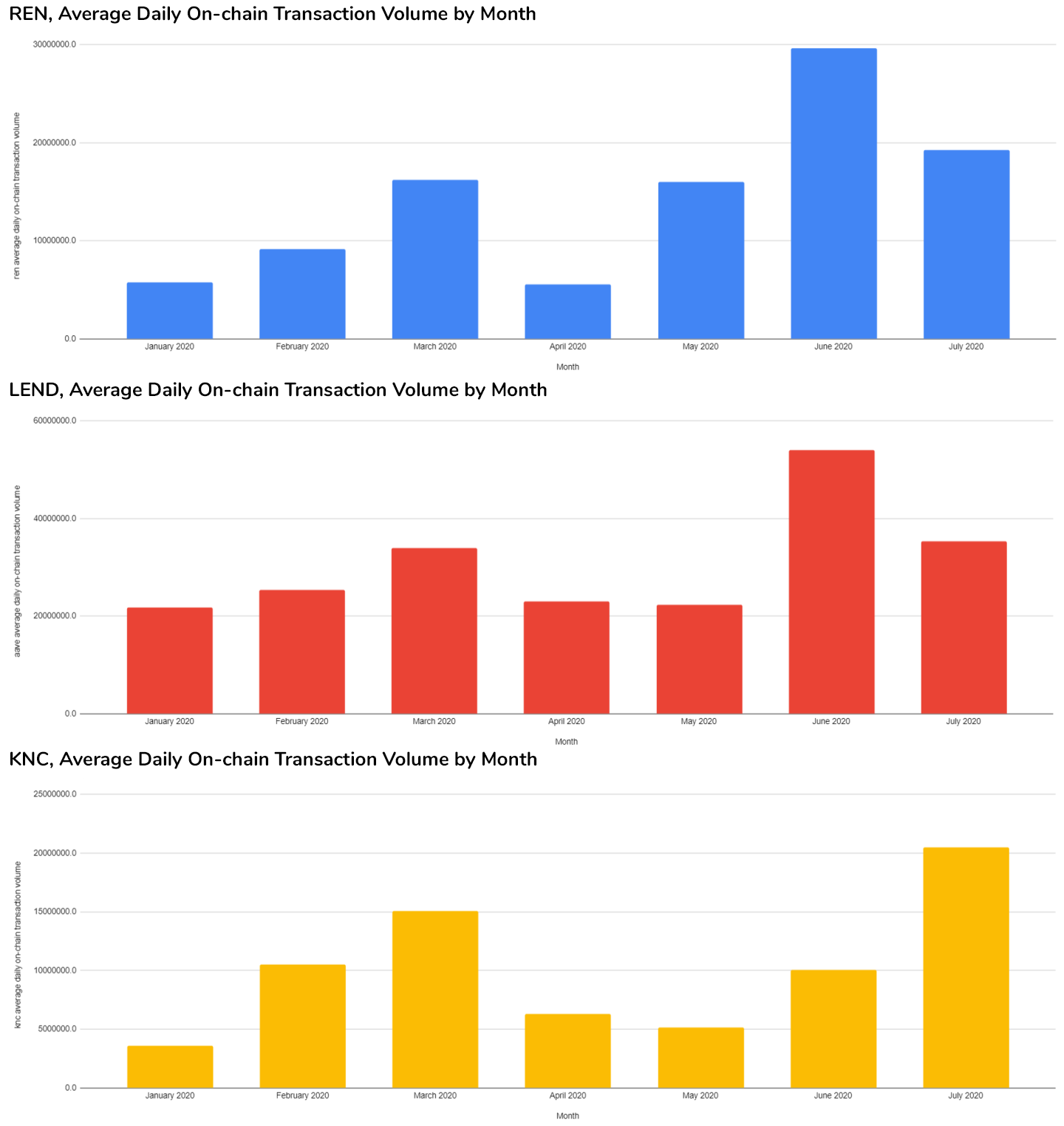

Finally, the three coins’ on-chain transaction volume, or the total amount of tokens being moved on the blockchain has experienced quite an uptrend as well, as their month-to-month view reveals:

Source: Santiment

2.) Decline in the Available Supply on Exchanges

Along with their price appreciation, all three coins have experienced a similar drop-off in the available supply located in known centralized exchange wallets. In the past 30 days alone, a total of 179 million REN has been withdrawn from exchanges (-8.5% drop). In the same time frame, LEND’s supply on exchanges has dropped by -5.1%, while the amount of KNC on exchanges was reduced by -93%.

LEND, supply on centralized exchanges, past year. Source: Santiment

The common pattern could point to a diminishing sell pressure and holder accumulation which gave room for the assets’ price to grow. Furthermore, assuming unchanged demand, the reduction of the coin’s available supply to trade could also be a contributing factor to their ongoing price appreciation.

3.) Top Holders Continue to Accumulate

Despite the coins’ astronomical gains, the top 100 non-exchange addresses holding REN, LEND and KNC (in other words their biggest ‘whales’) have all exhibited signs of accumulation in the past 30 days, pointing to high investor confidence and HODLer loyalty.

Amount of LEND held by top 100 non-exchange addresses, past year. Source: Santiment

In the past 30 days, the balance of top 100 KNC whales has grown by a total of 30.6 million KNC (~$48.1 million at the time of writing). In the same time frame, the top 100 LEND whales accumulated an additional 39.6 million LEND (~$10.1 million at the time of writing) to their collective bags, while the top 100 REN whales added 5.3 million REN (~$850,000 at the time of writing) more to their holdings.

4.) Retail Holders Are Growing

It’s not just the biggest holders that have been accumulating REN, LEND and KNC as of late - the amount of ‘retail holders’ has also been experiencing strong growth into the rally.

Since the start of the month, the number of addresses holding more than 1000 REN (~$150 at the time of writing) has increased by 550, the number of addresses holding more than 1000 LEND (~$250 at the time of writing) has increased by 817, while the number of addresses holding more than 100 KNC (~$157 at the time of writing) has grown by an additional 150.

Number of addresses holding more than 1000 REN, year to date. Source: Santiment

In a word, both ‘retail’ and large holders (on average) appear content with sitting on their bags, applying relatively little sell pressure for the time being.

5.) Strong and Consistent Development Activity

Development activity is an often-underrated indicator of project success, as it demonstrates the month-to-month dedication to creating a working product, continuously polishing and upgrading its features, and staying true to the promised roadmap.

Santiment tracks the projects’ development activity over time based on a number of pure development-related 'events' in the project’s public Github repositories. Based on this data, both Kyber Network and Ren’s github activity reveals high development throughput ever since the projects’ inception, and largely unaffected by their token’s short-term price action.

Kyber Network’s development activity, all time. Source: Santiment

And while AAVE mostly operates in closed Github repos, the project’s monthly community updates further confirm the team’s ongoing commitment to their long-term roadmap.

We want to thank Santiment for the analysis presented in this week’s newsletter. Santiment develops tools, strategies and indicators to help users better understand crypto market behavior and identify data-driven trading and investment opportunities. They are one of the industry’s biggest sources for on-chain, social media and development information on over 900 digital assets.

All readers can receive a discount when signing up for Santiment with the CRR referral link here. It’s only $44 a month to access all of these metrics.

Final Word for Investors. We are not sure if these three coins can sustain performance in the long-run or not, and this is why we consider them to be a short-term play. We will add them to the CRR’s portfolio for a few weeks.

Crypto Research Report Portfolio

Since January 1st, the CRR portfolio is up 74.13%.

Last week, the CRR portfolio had a 13% return within 7 days, and we decided to cash out 15% of our gains in expectation of a market-wide pull back. This week, some coins in the portfolio like Dash (-5%) and Bitcoin Cash (-5) went down, but others like Chainlink (+30%) and Cosmos (+11%) had substantial gains.

Our trades this week include adding REN, LEND and KNC and cutting Cosmos’ ATOM. We also had to renew our 3-month lending contract of Pax Gold on Crypto.com.

THE REST OF THIS SECTION IS FOR OUR MEMBERS ONLY. TO SEE THE COINS IN OUR PORTFOLIO SUBSCRIBE HERE.

In addition to the 74% year to date return, the portfolio is collecting interest payments, that range from 2% to 20% per annum as described below.

We are earning 6% APR on Bitcoin on BlockFi with no lock-up period. This is 1.5% higher than we are earning on our Bitcoin deposited at Crypto.com, which we have to lock-up for 3 months. We are earning 20% APR on our CRO staked on the Crypto.com exchange, which is locked up for six months, and we are earning 12% APR on our CRO staked in the phone app, which does not have a lock-up period. We are also earning 4% on our Pax Gold coins on the Crypto.com phone app on a three month contract. The Crypto Research Portfolio is staking Dash on the Celsius network and earning 6.71% per annum. The portfolio is also earning 8.32% on USDC and 2.53% annual interest on Bitcoin on the Celsius network.

That’s all for this week folks! If you would like to read our free 60 + page quarterly report supported by Bitpanda Pro, which is a regulated crypto exchange across Europe, and Coinfinity AG, a crypto asset broker based in Austria, please visit www.CryptoResearch.Report. The report is available in English and German.